Get Paid Earlier With the Bold Debit Card

The opinions expressed in this article are the author's own and do not reflect the view of Pathward,® N.A.

Imagine having the ability to access your paycheck sooner without waiting for the usual payday lag. With the Bold Visa® Debit Card, you can turn that possibility into reality.

Bold.org users can receive their paychecks up to two days earlier.** Early direct deposits can make a significant impact on your financial planning, especially if you’re looking to manage expenses more effectively each month. Even if you have a regularly scheduled payday, getting access to your money a bit earlier can be a real advantage.

During my brief stint as a waitress, we'd get paid every two weeks, give or take. The key phrase is give or take. Since I didn't have a regularly scheduled payday, I'd be left wondering when I was going to get paid some weeks. Whether that's the case for you (my condolences) or you just want early access, Early Pay is a great option to ensure you access your earnings in a more timely manner.

In this article, we'll cover how the Bold Debit Card can offer you unique perks, like early direct deposit payments, rewards, cashback, student loan payments, and more.*

The Bold Debit Card is legit and offers a safe and secure way for students to manage their money. Apply for a Bold Debit Card today and get your paycheck up to two days early!**

Apply for the Bold Debit Card today!

How to Set Up Bold Early Pay

1. Open a Bold Account with a Bold Debit Card

First, make sure you have a Bold.org student account. If you don’t have one yet, you can create a free account here. This student account allows you to access scholarship opportunities and apply for the Bold Debit Card.

If you already have a Bold.org student account, you can proceed to apply for the Bold Debit Card.

If you don’t have a Bold.org student account, you’ll need to create one. During this process, you’ll provide basic information about your academic journey, including your GPA and intended field of study. This helps us match you with relevant scholarships and build a profile to unlock exclusive opportunities.

Once your student account is created, you can then navigate to the Bold Debit Card application. This application involves answering a series of questions that lead to earning Bold Points* along the way. You’ll then be able to order the debit card, which will open your Bold Account—a demand deposit account with a Bold Debit Card.

Get Started with the Bold Debit Card

Earn rewards that help pay for school.* Apply for the Bold Debit Card today!

Join Bold.org2. Choose a Direct Deposit Option

Now that your Bold Account is open, you can set up Early Pay by choosing a direct deposit option.

Online:

This option allows Bold.org to link your accounts with no extra action needed from you.

- Navigate to the Early Pay setup page on Bold.org

- Click 'Set up Early Pay'

- Choose 'Find Your Employer' (this is the recommended option)

- A popup will appear asking if you want to update your direct deposit to Bold.org; select 'Continue'

- Choose how much of your paycheck you'd like to receive up to two days early

- Scroll through options or use the search bar to find your employer; select your employer

- Sign in to your account with your employer and allow Bold.org to verify your credentials

Bold Mobile App:

- Log into the app

- On your home screen, select 'Set up Early Pay'

- Choose 'Find Your Employer' (this is the recommended option)

- Choose how much of your paycheck you'd like to receive up to two days early

- Scroll through options or use the search bar to find your employer; select your employer

- Sign in to your account with your employer and allow Bold.org to verify your credentials

Share Account Details with Your Employer:

Another way to set up direct deposit is to send your account information to your employer or payroll provider.

- Navigate to the Early Pay setup page on Bold.org

- Click 'Set Up Early Pay'

- Choose 'Proceed Manually'

- Select your payroll provider

- Bold.org will provide you with account and routing numbers

- Send the account information to your HR department to link your payroll to the Bold Debit Card

You'll have to speak with your employer or payroll provider to make sure the process is completed. You can also access this information on the mobile app.

3. Get Your Paycheck Earlier**

Once you've set up direct deposit, you're ready to go. You can enjoy the convenience of accessing your paycheck earlier.

How Bold.org Gets You Paid Up to Two Days Early**

Receiving your paycheck earlier can be very helpful, but how does Bold's Early Pay work? Bold.org makes your paycheck funds available immediately once we receive them from your employer or payroll provider. We typically make your paycheck funds available on the same day we receive them from your employer, which could be up to two days earlier than your scheduled payment date.

Payments are typically processed on business days (Monday through Friday). If you were expecting an early paycheck and haven't received it yet, it could be delayed due to a bank holiday. If there is no holiday, please contact your employer to confirm if your paycheck has been processed.

Do you want to get paid early, but your current bank account doesn't have this option? Apply for a Bold Debit Card today and potentially pay bills sooner.

Early Pay Gives You Free Bold Points

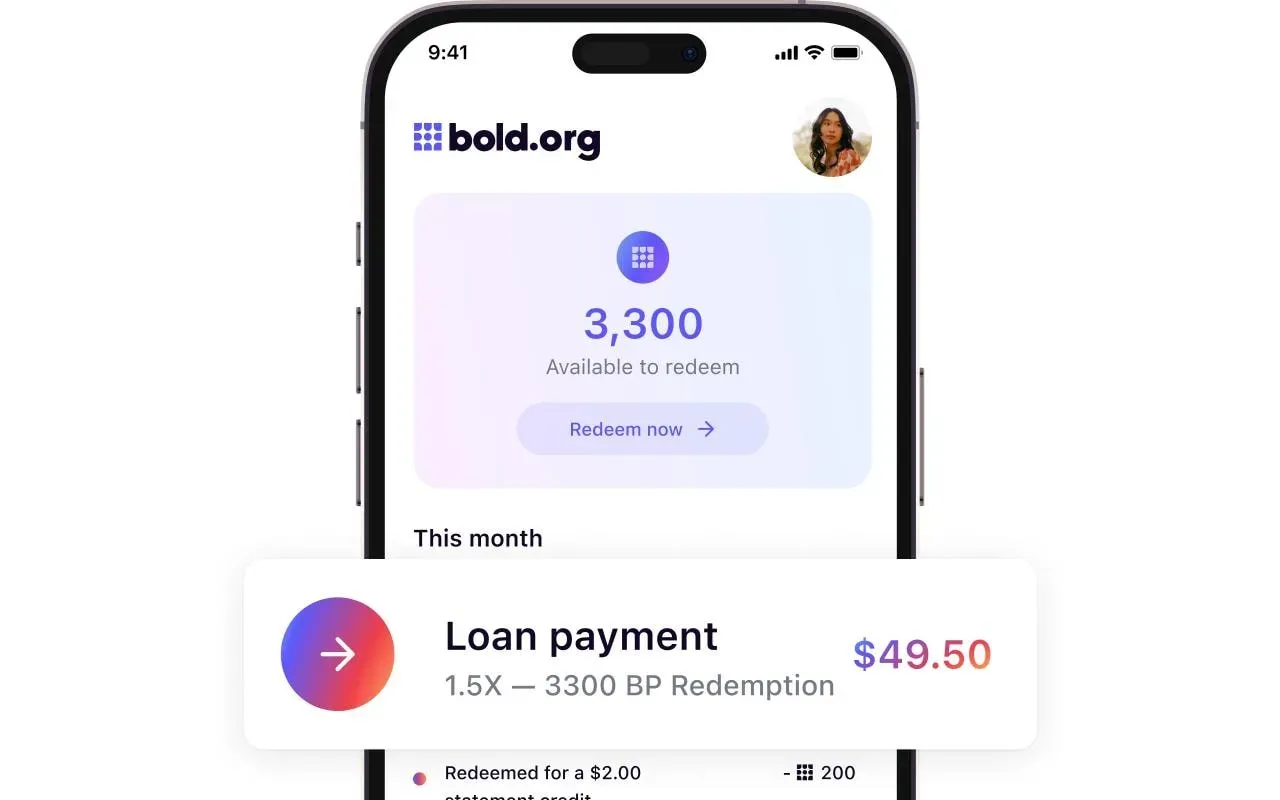

Besides depositing money in your account up to two days earlier, opting for Early Pay also earns you 300 Bold Points!¶ But why is that a good thing?

When you set up Early Pay, you immediately get 300 Bold Points. As you continue to use the Bold Debit Card, you'll continue to earn Bold Points. When you use the Bold Debit Card, you earn 1 Bold Point for every $1 spent on eligible purchases across categories. There's no cap on how many Bold Points you can earn.

You can use Bold Points for two things:

- Cashback

- Student Loan Payments

2,000 Bold Points converts to either $10 cashback or $15 towards your student loan payments. The Bold Points calculator allows you to see how much you can get as cashback or loan payments depending on your current Bold Points balance. Check it out!

If you use the Bold Debit Card to buy $120 worth of groceries for the week, you'll earn 120 Bold Points. Think about how much money you spend from your checking accounts each month. With the Bold Debit Card, you can turn those everyday purchases into opportunities for rewards, like cashback or student loan payments.

Earning Bold Points for Cashback*

You earn 1 Bold Point for every $1 you spend, so if you have 7,000 Bold Points, you can get $35 in cashback. With the Bold Debit Card, you can make your everyday spending work for you by accumulating Bold Points that convert to real money! Make the most of your earnings by getting them ahead of schedule!

Earning Bold Points for Student Loan Payments*

If you have 7,000 Bold Points, you can redeem them for $52.5 toward your student loan payments. By getting your funds earlier, you can start earning rewards on your expenses sooner and use them to help reduce your student debt more quickly. Let Early Pay and Bold Points work together to help you reduce your student loans! With student loans, every day matters as interest accrues daily.

Related: How Does Student Loan Interest Work?

No Hidden Fees¶

A Bold Account with a Bold Debit Card has no late fees, hidden fees, overdraft fees, or foreign transaction fees, and you won't be charged a monthly service fee either. Plus, there are no extra fees to get early paycheck access. In addition, when you set up direct deposit, you don't need to meet minimum balance requirements like many other accounts. Learn more about fees.

Bold.org is trusted by thousands of students as a reliable resource on scholarships, finance, and student living. Learn more about the Bold Debit Card today!

Frequently Asked Questions About Early Pay

How does early pay work?

Paychecks often take a few days to process before they're deposited in your checking account. Bold.org removes that wait time. We offer early direct deposit with our Early Pay feature.** As soon as Bold receives your paycheck funds, we will add the funds to your account.

What are eligible direct deposits?

Eligible direct deposits generally refer to electronic deposits made to your account by your employer, a government agency, or other organizations that provide regular payments. For a deposit to be considered eligible, it must be made electronically through an Automated Clearing House (ACH) transfer directly into your account.

How do I get a Bold Debit Card?

Any student can sign up for a Bold.org account and check if they qualify for the Bold Debit Card. Fill out a few forms with basic personal information, and if you qualify, your debit card will be mailed to you. While waiting for it to arrive, you can start making purchases using your virtual Bold Debit Card by adding it to your mobile wallet.

Make a free profile with Bold.org today and get paid up to two days early when you enable Early Pay with the Bold Debit Card!

Bold.org Visa® Debit Card is a demand deposit account provided by Pathward®, N.A., Member FDIC. Bold.org Visa Debit Card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card can be used everywhere Visa debit cards are accepted. Visa is a registered trademark of Visa U.S.A. Inc. All other trademarks and service marks belong to their respective owners. Register your Card for FDIC insurance eligibility and other protections.

*This product or service is independent of Pathward® and Visa and is neither endorsed nor sponsored by Pathward® or Visa.

**Early direct deposits will generally be posted on the day they are received, which may be up to two business days prior to the scheduled payment date. Some direct deposits may not be eligible for Early Pay. Early Pay may be delayed due to fraud prevention screening, system processing, or account restrictions. Get in touch at contact@bold.org with any Early Pay questions.

†Funds are FDIC insured, subject to applicable limitations and restrictions, once Pathward receives the funds deposited to your account. For more specific and up-to-date information about coverage and limitations, see the FDIC website.

¶The features associated with the Bold Debit Card discussed in this blog post are provided by Bold.org and are not affiliated with our Bank partners, Pathward®, or Visa.

About Elise

Elise is a skilled and knowledgeable writer. Her understanding of scholarships and internships enables her to craft insightful and informative content that resonates with students, helping them navigate the often complex processes of applying for financial aid and career opportunities.

Elise graduated from New York University with a double major in English and Psychology, as well as a minor in Creative Writing.

Experience

Through challenging university coursework and corporate experience, Elise has become an expert in several different types of writing, including literary analysis, content pieces, formal scientific writing, SEO editing, and more. Elise expanded on her knowledge while interning in marketing, using her understanding of SEO to boost website traffic and customer engagement.

She’s published a short story in The Foundationalist literary magazine and has also won several short story writing awards at the regional and international levels. Elise loves to craft content that helps students navigate college life and scholarship applications. She makes use of syntax and tone to write readable, engaging pieces. Elise has a solid understanding of linguistics and grammatical structures across multiple languages, thanks to her fluency in English and proficiency in Mandarin and Cantonese.

Elise first joined Bold.org in 2022 during her undergraduate studies, explored other pursuits in 2023, and happily returned in 2024. Motivated by her writing skills, she aims to make educational resources more accessible for students of all backgrounds. Additionally, she believes it's important to add to the available information on student loans and student finances in a way that's user-friendly and easy to understand.

Quote from Elise

“I try to create content that would have helped my younger self— stuff I wish I knew when I was starting college.”