Free Debit Cards with No Monthly Fees in 2025

The opinions expressed in this article are the author's own and do not reflect the view of Pathward®.

As a student, you are faced with many new responsibilities: college classes, student loans, first jobs, and, of course, new financial responsibilities. You may even be opening a new debit card for the first time! This can be an exciting step in your life, but it also brings on a new financial responsibility.

In today's digital age, debit cards have become an essential tool for managing our finances. They provide a convenient and hassle-free way to make payments, whether you're shopping online or swiping your card at a local store. But what if we told you that there's a way to get a debit card for free? Yes, you heard it right - free debit cards are a reality!

In this article, I’ll explore everything you need to know, from choosing the right debit card to the sign-up process. This will give you confidence as you embark on your financial journey!

Sign up for a Bold.org account today to read more articles like this one and gain access to thousands of scholarships to make navigating finances in college easier.

The Concept of Debit Cards

Before we dive into the benefits and features of debit cards, let's take a moment to understand what exactly a debit card is. Simply put, a debit card is a payment card that allows you to make transactions directly from your bank account. Unlike credit cards, which involve borrowing money that you have to pay back, debit cards enable you to spend your own funds.

Debit cards have become an essential tool in today's almost cashless society. They offer convenience and security, allowing you to make purchases online, in stores, and even withdraw cash from ATMs. You can even make a mobile check deposit right with your banking app.

With a debit card, you can easily track your expenses as each transaction is recorded in your bank statement.

Get Started with the Bold Debit Card

Earn rewards that help pay for school.* Apply for the Bold Debit Card today!

Join Bold.orgLittle to No Fees

Now, let's explore the concept of 'free' in the context of debit cards. It means that certain financial institutions offer these cards without charging any annual or monthly fees. This can be particularly beneficial for people looking to save money on banking fees and keep their finances in check, especially students.

When you opt for a free debit card, you can enjoy its convenience and functionality without worrying about additional costs. This can be especially great for those who frequently use their debit cards for everyday transactions, as the absence of fees can save them a significant amount of money over time.

Many free debit cards also have no cash deposit fees. A great card option with no hidden fees is the Bold Visa® Debit Card. Sign up today!

Apply for the Bold Debit Card today!Exploring Free Debit Cards: Traditional & Non-Traditional Options

Bold Account and Bold Visa® Debit Card

If you are a student looking for a first-time debit card (or just looking to open another card), the Bold Debit Card may be an option for you.

The Bold Debit Card is designed with students in mind and connects with a Bold.org account. This means scholarships and banking are all in the same place!

On Bold.org, users collect Bold Points,* which help when applying for scholarships. These points can also be redeemed as cashback or money toward student loan payments. For every $1 spent, users earn 1 Bold Point.

For example, 2,000 Bold Points is equal to $10 in cashback or $15 in a student loan payment. There is a 1x reward for cashback and a 1.5x reward if being redeemed toward student loan payment.*

The card also allows for direct deposit, enabling paychecks to go directly to your Bold Account, which is a demand deposit account, and there are no hidden fees.† Being a student is stressful enough, so you never have to worry about being charged a fee that you did not know about with a Bold Debit Card.

Apply for the Bold Debit Card today!How to Sign Up

To sign up for the Bold Debit Card, apply online at Bold.org. After providing basic information, applicants will know if they are approved, and then they can order the debit card.

The Bold Debit Card is different because it is designed with students in mind. It is the debit card that helps pay for school, which also helps you save money. Making your regular daily purchases can become a new way to tackle student loans.

Chime Checking Account and Visa® Debit Card

Another option for a free debit card is the Chime Visa Debit Card offered in connection with the Chime Checking Account.

This account does not have a monthly account fee, maintenance fees, or a minimum balance. You can control all your card settings right from the app. The flexibility of the Chime Visa Debit Card makes it a great option for new debit card users and students as well.

How to Sign Up

To sign up, you can apply online by answering a few simple questions. Then, you can download the Chime app and connect with a current bank account to send money or set up direct deposit. You can use your temporary Chime card for online purchases until your physical debit card comes in the mail.

For more specific and up-to-date information, visit Chime's official website or their help section.

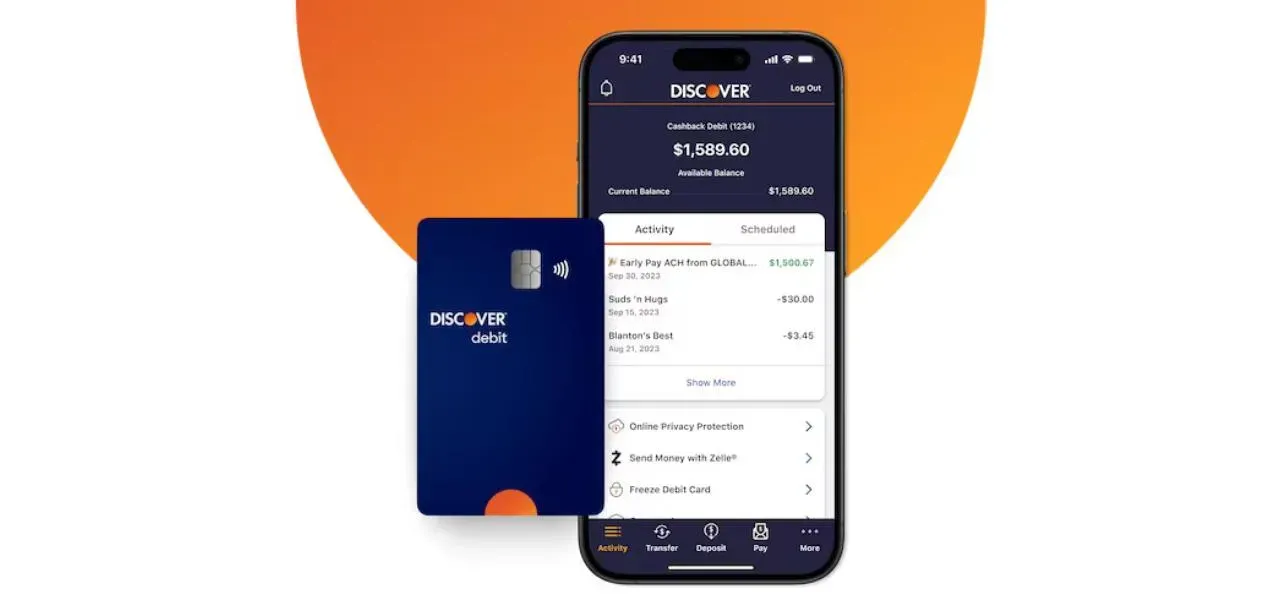

Discover Cashback Checking Account and Debit Card

The Discover Cashback Debit Card is another option to look into, as it allows you to earn cashback on daily purchases.

With this account, you are able to earn 1% cashback on up to $3,000 of purchases a month. If you set up direct deposit with your Discover Cashback Checking Account, you are paid two days early as well which is great for users, including students. The account has no monthly fee, no balance requirement, and no fee for insufficient funds. If you ever lose your debit card, the replacement is free.

How to Sign Up

To sign up, you apply on the Discover website. You’ll be asked to fill out some basic information about yourself. After you've set up the checking account, your debit card will be sent to you.

For more specific and up-to-date information, visit Discover’s official website.

The Benefits of Debit Cards

Debit cards have become increasingly popular in recent years due to their numerous advantages. Not only do they offer financial management and budgeting benefits, but they also provide accessibility, convenience, safety, and security.

Financial Management and Budgeting

One of the most significant advantages of debit cards is that they can help you stay on top of your finances. With a debit card, you can only spend the amount that is available, which helps prevent you from overspending and helping you stick to a budget. This can help promote responsible financial decision-making.

Debit cards are usually connected to a checking account or demand deposit account, but they can not be connected to a savings account. If you properly manage your budget and allocate money to your checking and savings accounts, you will only be spending money that you should be.

Because debit cards are usually connected to your checking or demand deposit account, they often come with online banking features that allow you to track your expenses and categorize them accordingly. This feature enables you to analyze your spending patterns, identify areas where you can cut back, and set financial goals for yourself.

Having a clear overview of your financial situation can help you make informed decisions and work towards achieving your financial objectives.

Accessibility and Convenience

Gone are the days of carrying wads of cash or writing checks. Debit cards offer accessibility and convenience. Whether you need to make a purchase in-store, withdraw cash from an ATM, or shop online, your debit card is your trusty companion.

It eliminates the need to carry large sums of money, provides a secure way to make transactions, and allows you to keep track of your expenses effortlessly.

Furthermore, debit cards are widely accepted both domestically and internationally. This means that you can use your card to make purchases or withdraw cash wherever you go without the hassle of carrying multiple forms of payment. Whether you're traveling for business or leisure, having a free debit card in your wallet makes it easy to access your funds whenever and wherever you need them.

Be sure to check your specific debit card to understand the features offered by your debit card and any fees that may be incurred.

Safety and Security

When it comes to money matters, safety and security should always be a top priority. Debit cards provide peace of mind as they come equipped with advanced security features. For many debit cards, each transaction is protected by encryption and requires authorization from your personal identification number (PIN). This ensures that only you can access and use your card.

Additionally, many financial institutions offer round-the-clock fraud monitoring to detect and prevent any unauthorized activities. In the event of suspicious transactions, you will be promptly notified, allowing you to take immediate action to protect your account. Some banks even offer zero liability protection, meaning that if your card is lost or stolen, you won't be held responsible for any fraudulent charges.

Moreover, debit cards often come with additional security features, such as chip technology, which provides an extra layer of protection against counterfeit fraud. This technology encrypts your card information and generates a unique code for each transaction, making it virtually impossible for fraudsters to clone your card or steal your sensitive data.

Rewards Programs

Some debit cards often come with additional perks and benefits. Some financial institutions offer rewards programs where you can earn cashback or points for every purchase made using your debit card. These rewards can be redeemed for various products, services, or even cash, providing you with an extra incentive to use your debit card for your everyday expenses.

Flexibility

Another advantage of debit cards is the flexibility they offer. You can link your debit card to various payment platforms and digital wallets, allowing you to make contactless payments using your smartphone or smartwatch. This makes transactions even more convenient and secure, as you don't have to carry physical cash or cards with you.

Another great thing to look out for as a student is scholarships. Check out Bold.org for thousands of exclusive scholarships today.

How to Obtain a Debit Card

Are you tired of paying fees for using your debit card? Well, you're in luck! Many financial institutions now offer debit cards free of cost to their customers. These cards provide a convenient and cost-effective way to access your funds without any additional charges. So, how can you get your hands on one of these cards? Let's dive into the details.

Application Process for Checking or Demand Deposit Accounts

Now that you know the eligibility criteria, let's move on to the application process for obtaining a free debit card by applying for a transaction account. Fortunately, most accounts have made this process incredibly simple and convenient, allowing you to apply online from the comfort of your own home.

First, it is important to do research on different institutions or organizations with which to open an account. You might want to look for institutions or organizations that do not require a minimum balance and do not have a monthly fee.

Visit the institution or organization’s website and navigate to the page dedicated to applications. Here, you can find information about the application process. Typically, account applications may ask for your personal details, such as your name, date of birth, contact information, and social security number.

In addition to your personal information, often you will also need to provide the required documents to support your application. This may include scanned copies of your identification documents, proof of address, and any other documents specified by the institution or organization. Make sure to double-check the requirements before submitting your application to avoid any delays or rejections.

Once you have completed your application, the institution or organization will review your application and verify the information provided. This process may take a few business days, so be patient.

If your application is approved, congratulations! The institution or organization will open your account, issue your free debit card, and deliver it to your registered address. Depending on their policies, you may receive your card via mail or have the option to pick it up from a local branch. Once you have your card in hand, you can activate it following the instructions provided.

Features of Debit Cards

Transaction Limits and Charges

When choosing a debit card, it's important to consider the transaction limits and charges associated with the card. Some cards may have daily or monthly transaction limits, while others may charge fees for certain transactions, such as international purchases or ATM withdrawals.

Make sure to read the terms and conditions before selecting a card that best suits your needs.

Overdraft Facilities and Penalties

While overdraft facilities can be a useful feature for some, it's essential to understand the associated penalties. Some cards come with overdraft options that allow you to spend more than the available balance in your account. However, overdrafts often come with fees, so it's crucial to use this feature responsibly and be aware of the potential financial implications.

Rewards and Incentives

In an attempt to attract customers, many banks offer rewards and incentives with their debit cards. For example, some cards offer a certain percentage of cashback with debit card purchases or loyalty points that can be redeemed for various rewards.

So, when comparing different cards, take a closer look at the rewards programs they offer and consider which ones align with your spending habits and preferences.

Comparing Debit Cards from Different Banks

Factors to Consider When Choosing a Free Debit Card

Choosing a debit card that suits your financial needs requires careful consideration. Here are some factors to keep in mind:

- Reputation: Opt for a debit card from a reputable bank or company that offers excellent customer service and has a strong presence in the financial industry.

- ATM Network: Check if the bank has an extensive ATM network. The more ATMs available, the easier it will be for you to access your funds without incurring additional fees.

- Additional Services: Consider the additional services offered by the bank, such as online banking, mobile apps, and bill pay options, as they can enhance your overall banking experience.

Interested in reading more articles on college life, finances, applications, and more? Visit our Scholarship Blog today and read more informational articles like this one!

Frequently Asked Questions About Free Debit Cards

Why should a student choose a debit card over a credit card?

A student may choose a debit card over a credit card because they know that they are always spending their own money rather than spending a credit limit. This way, you always know how much money you can spend and how much you should save. You don't have to worry about making payments on time because you are spending money straight from your account.

Who can sign up for the Bold Debit Card?

The Bold Debit Card was made for students and people with student loans. So, if you fall into that category, you are a perfect candidate for the Bold Debit Card. You do need to have a Bold.org account to start the process. If you don't have one, sign up today!

Where can you use the Bold Debit Card?

You can use the Bold Debit Card anywhere that Visa debit cards are accepted. Have your card on you to earn Bold Points wherever you go.

If you're interested in the Bold Debit Card, make sure to sign up for a Bold.org account to be eligible. Join the Bold.org community today!

No brands, products, or companies mentioned are affiliated with Bold.org, nor do they endorse or sponsor this article.

Bold.org Visa® Debit Card is a demand deposit account provided by Pathward®, N.A., Member FDIC. Bold.org Visa Debit Card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card can be used everywhere Visa debit cards are accepted. Visa is a registered trademark of Visa U.S.A. Inc. All other trademarks and service marks belong to their respective owners. Register your Card for FDIC insurance eligibility and other protections.

*This product or service is independent of Pathward® and Visa and is neither endorsed nor sponsored by Pathward® or Visa.

†The features associated with the Bold Debit Card discussed in this blog post are provided by Bold.org and are not affiliated with our Bank partners, Pathward®, or Visa.

About Safa

Safa is a great writer and researcher. She brings a unique blend of creativity and analytical skills to our writing team, honed through her diverse experiences in both literary and media fields.

Safa is an undergraduate student at the University of Michigan majoring in English and Creative Writing with a minor in User Experience Design.

Experience

Safa has always loved writing and reading. She loves to write poetry and informational articles. She was an English summer intern at Michigan News where she assisted in planning, researching, and writing news articles. With the knowledge she gained at this internship, she became a skilled article writer.

She now works for Michigan News as a media assistant, focusing on graphics and social media writing. Safa’s poetry collection, “Let Us Get Lost in the Valleys,” was a first-place winner of the Hopwood program's Keith Taylor Award for Excellence in Poetry by the University of Michigan in 2023. She also won the Seham Elasmar Memorial Scholarship for writing and media from the Islamic Scholarship Fund to support her English education. Safa's experience and passion for writing allow her to provide students with valuable information and insights.

Safa is no longer with the Bold.org Writing Team, but we continue to value and appreciate her contributions.