5 Great Debit Cards with Cashback Rewards in 2025

The opinions expressed in this article are the author's own and do not reflect the view of Pathward®.

Looking for a debit card that not only helps you make convenient payments but also rewards you with cashback? Your search ends here! In this article, we explore 5 debit cards with cashback rewards that can help you save money while you spend. Notably, our Bold Debit Card, thoughtfully designed with students in mind, offers amazing rewards* that chip in for your school expenses. Let's jump right in!

Debit Cards with Cashback Rewards

When it comes to choosing a debit card with cashback rewards, there are plenty of options available in the market. In this detailed review, we explore the key features and benefits of the top 5 debit cards that offer cashback rewards.

The Bold Debit Card: Cashback for Student Loans

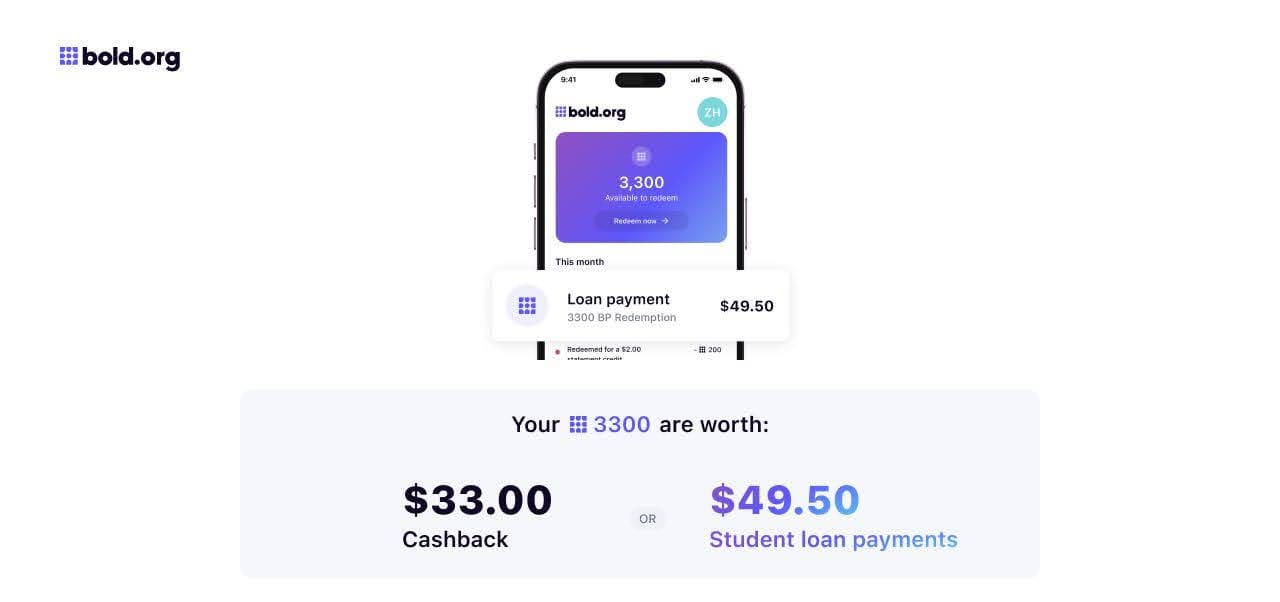

The Bold Debit Card is great for those looking to supercharge their financial rewards. What sets the Bold Debit Card apart is its unique feature, which helps you reduce your student loans with rewards. You can redeem your Bold Points* for direct student loan payments, reducing that debt with every swipe.

With this debit card, you can earn 1 Bold Point* for every $1 spent across any category. Whether you're buying groceries, sipping coffee, or upgrading your wardrobe, all your purchases add up to sweet points. You can double-tap that reward with opportunities to boost your points on specific purchases throughout the Bold.org platform, including exclusive deals, partnerships, and targeted bonus opportunities.

If loan payments aren't your thing, don't worry; you can also cash out your Bold Points* for extra spending wiggle room. There are no annual or monthly fees!

Here at Bold.org, security is a top priority, and with the Bold Debit Card, you can sleep easy knowing your funds are protected by uncompromising security measures and backed by $250k FDIC insurance for your deposits at banks and institutions covered by FDIC insurance.** Plus, streamline your finances with direct deposit and easy transfers, making money movement seamless.†

Get Started with the Bold Debit Card

Earn rewards that help pay for school.* Apply for the Bold Debit Card today!

Join Bold.orgDiscover Student Debit Card: Cashback Bonus at Restaurants

If you're looking to get more for your money, consider the Discover Cashback Debit card with 1% cashback on up to $3,000 in purchases each month. You can earn cashback on your everyday spending, and there are no fees associated with the checking account linked to it.

This means you won't be charged any fees for maintaining your account, making it a cost-effective choice, including overdraft fees.

You can also enjoy the perk of getting paid up to two days early when you set up direct deposit for your online checking account. This early paycheck feature can help you access your funds sooner, providing financial flexibility.

With 1% cashback debit cards, no fees, the opportunity to earn a 5% Cashback Bonus for a limited time, and the option to receive your paycheck early, this debit card is designed to make your money work harder for you.

For more specific and up-to-date information, visit Discover’s official website.

Affinity Plus Debit Card: Online Stores and Cashback

An Affinity Plus debit card from Visa is the perfect companion for avid online shoppers. This card is tailor-made for those who love to shop online, offering an array of enticing benefits. With an attractive 5% cashback rate on select online retailers, you can earn substantial rewards while indulging in your favorite online stores.

This debit card also ensures your peace of mind with its enhanced security features, providing added protection for your online banking transactions. You can also shop internationally without worrying about additional charges.

For added convenience, you can get your monthly direct deposits up to 2 days early with this debit card, allowing you quicker access to your funds. Plus, it supports fast checkout, and you can tap to pay wherever you see the contactless symbol, making transactions swift and easy.

Pay with your digital wallet, including Apple Pay, Google Pay, Samsung Pay, and more, for a seamless payment experience. Additionally, you can enroll your account in 'Stash Your Cash' to automatically round up your debit card purchases to the next dollar, with the spare change going directly to your savings account.

With no annual fee, the Affinity Plus debit card is a win-win for online shopping enthusiasts, offering cashback, enhanced security, and convenient features to make your online shopping experience even more rewarding.

For more specific and up-to-date information, visit Affinity’s website.

Alliant Credit Union: Money Management

Alliant Credit Union, owned by its members, sets itself apart from traditional banks by prioritizing lower fees and better rates, directly benefiting your teen's financial experience. For the teenage years, which are crucial for learning responsible money management, Alliant Teen Checking is the perfect fit. Here's why it stands out:

Ages 13-17 are welcome, giving your teen access to real-world money management under safe guidance. With joint ownership, parents can maintain ultimate control while fostering financial responsibility. Parents who are also Alliant Members can easily transfer money anytime. Say goodbye to hidden charges and surprise expenses, as Alliant Teen Checking comes with no fees and no fuss.

The mobile app allows your teen to learn on the go, track purchases, budget, and check balances with ease. They can also enjoy widespread ATM access with their 80,000+ network in your area. Both the parent and teen receive their own contactless Visa debit card for quick and secure payments.

By opting into eStatements and making regular deposits, your teen can earn a competitive interest rate, providing a taste of financial rewards while learning. Rest assured, the account is protected by state-of-the-art security measures to keep it safe from fraud.

This debit card, offered by Alliant Credit Union, is a versatile option that caters to a wide range of spending categories. With an excellent offer cashback rate of 2% on all purchases, this card allows you to earn rewards on every swipe. But that's not all – it also offers additional bonus rewards in specific spending categories, such as groceries, gas, or entertainment.

Its rewards program is easy to use, and you have various redemption options available, including statement credits and gift cards.

For more specific and up-to-date information, visit Alliant’s website.

Revolut: User-Friendly Mobile App and Traveling

If you're a frequent traveler, the Revolut debit card is tailored to meet your needs. With Revolut, you'll enjoy an easy-to-use and visually appealing mobile app that allows you to effortlessly manage your bank account, transfer money, and gain insights into your budget and spending.

When it comes to fees, Revolut debit card offers a range of plans to choose from, with annual fees varying from $0 to $16.99 per month, depending on the features you need.

If you're concerned about foreign transaction fees, Revolut Premium offers fee-free foreign transactions up to a monthly limit (varies by subscription plan), with a fair exchange rate fee beyond the limit.

You can also enjoy unlimited free ATM withdrawals each month, with a daily limit of $550. Cash withdrawal limits vary depending on the subscription plan you have and how long you’ve had your account open.

What sets Revolut Premium apart is its cashback program, offering varying cashback rates depending on the partner and subscription plan, ranging from 0.1% to up to 1% on spending in European countries. You can travel hassle-free! Learn more about Revolut on their website.

For more specific and up-to-date information, visit Revolut’s website.

Cashback Rewards

When it comes to managing your finances, it's always a good idea to explore different ways to save money and maximize your spending. One popular option that many people turn to is cashback rewards. These rewards programs, offered by banks and financial institutions, allow you to earn a percentage of your spending back. But how exactly do cashback rewards work?

How Do Cashback Rewards Work?

When you make purchases using your debit card, a certain percentage of your spending is returned to you as cashback. This percentage can vary depending on the specific debit card.

Let's say you have a debit card that offers 1% cashback on all purchases. If you spend $100 on groceries, you will earn only $1 in cashback on your debit card. Those rewards from your debit card purchases can add up and provide you with some extra cash in your checking account.

For the Bold Debit Card, every $1 spent earns you 1 Bold Point on eligible purchases. Bold Points* can be redeemed either as cashback or used toward your student loan payments. For example, if you spend $60 on your Bold Debit Card, you’ll earn 60 Bold Points. Now, let's say you have 2,000 Bold Points. You can redeem these points for $10 in cashback or $15 toward your student loans.

It's important to note that cashback rewards are typically credited to your checking account on a regular basis. This can be monthly, quarterly, or annually, depending on the debit card issuer's policies. Some debit cards may also have a minimum before you can redeem your cash rewards with your debit cards.

Check out these thousands of scholarships! If you have leftover funds from your scholarships or financial aid, you can deposit them into your bank and use the funds on your debit card.

Apply for the Bold Debit Card today!Benefits of Cashback Rewards

Cashback rewards allow you to earn money on everyday purchases. Whether you're buying groceries, filling up your gas tank, or dining out at your favorite restaurant, you can earn a certain percentage of your spending with your cashback debit card. This can be especially beneficial if you have regular expenses that you can't avoid.

Cashback rewards can help offset some of the card's annual or monthly fees or other charges. Many debit cards with cashback rewards come with certain fees, such as an annual fee or foreign transaction fee. However, the Bold Debit Card has no fees, meaning you save even more! By earning cashback rewards on your purchases, you can make your card more cost-effective and knock out some student loans.

The Benefit of Flexibility

Debit card cashback rewards give you the flexibility to use the money earned however you prefer. Unlike other rewards programs that may limit your redemption options, cashback rewards can be used for anything you want. Whether you want to save it for a rainy day, treat yourself to something special, or put it towards paying off your credit card bill, the choice is yours.

With the Bold Debit Card, Bold Points do not expire. So, you can rack up your points to put a dent in your student loans!

Factors to Consider When Choosing a Debit Card with Cashback Rewards

Reward Rates and Categories

One important factor to consider when choosing a debit card with cashback rewards is the reward rates and categories. You want to avoid monthly fees, overdraft fees, or a minimum balance requirement. It's also worth considering if the debit card reward rates and categories align with your long-term financial goals.

Some cards offer higher cashback percentages on specific spending categories, such as gas stations or restaurants. Make sure to choose a card to maximize your debit card rewards. If you frequently dine out at restaurants, you may want to look for a debit card that offers a higher cashback percentage for dining expenses. This way, you can earn more rewards for something you already do regularly.

Or, if you want to put a dent in your student loans, consider the Bold Debit Card cashback rewards program.* Our debit card allows you to make direct loan payments with your rewards points! Our card gives you rewards that help fund your education.

Annual Fees and Other Charges

Another factor to consider is the monthly or annual fees and other charges associated with the debit card. While debit card cashback rewards can be enticing, it's important to weigh the value of the rewards against any fees you may incur. Look for cards that offer competitive rewards without imposing excessive monthly fees. With the Bold Debit Card, you lose all the fees!

When comparing different debit cards, take note of any additional charges beyond the annual fee. Some cards may charge fees for foreign transactions, balance transfers, or late payments.

These fees can eat into your cashback rewards if you're not careful. Consider if the debit card offers any perks or benefits that can offset the annual or monthly fees. Some debit cards with cashback rewards may provide additional features like purchase protection, extended warranty coverage, or travel insurance. These added benefits can enhance the overall value of the debit card and make it more appealing.

Redemption Options and Limitations

Before making your decision, also consider the redemption options and limitations of each debit card. Some debit cards may require you to accumulate a certain amount of cashback before you can redeem it, while others offer instant redemption. Check if there are any restrictions on how you can use your cashback rewards, such as minimum withdrawal amounts or expiration dates.

Some debit cards may only allow you to redeem your cashback as statement credits, which can help reduce your outstanding balance. Other debit cards may offer more flexibility, allowing you to redeem your rewards as cash direct deposit into your bank account, gift debit card, or even charitable donations.

It's important to understand the redemption process and any limitations associated with it. If you prefer to have instant access to your cashback rewards, look for a debit card that offers immediate redemption options. If you're willing to wait and accumulate a higher cashback balance before redeeming, a debit card with a higher minimum redemption threshold may be suitable for you.

Be aware of any expiration dates on your cashback rewards. Some debit cards may impose time limits on when you can redeem your cashback rewards, so it's essential to use them before they expire. If you're not a frequent spender or if you tend to save up your rewards for larger purchases, make sure the debit card expiration policy aligns with your spending habits.

Tips to Maximize Your Cashback Rewards

When it comes to maximizing the cashback rewards of your debit card, there are a few strategic tips that can help you make the most out of your spending. By carefully planning your purchases and keeping a close eye on your reward points, you can ensure that you are getting the most bang for your buck.

Strategic Spending

One of the key ways to maximize your cashback rewards is to strategically plan your spending. Take a look at the categories that offer higher cashback rates and concentrate your purchases in those areas.

If you have a debit card that offers 5% cashback on groceries, consider doing your grocery shopping with that card to earn more rewards.

Some debit cards offer rotating categories that change every quarter. These categories often offer higher cashback rates for a limited time. By keeping track of these rotating categories, you can plan your purchases accordingly to take advantage of the increased rewards.

Regularly Monitor Your Reward Points

It's essential to stay vigilant about monitoring your reward points to make the most of your cashback rewards. Setting up notifications or alerts on your debit card account can be a handy tool.

These reminders can help you keep track of upcoming redemption opportunities and any bonus cashback offers, ensuring you don't miss out on valuable rewards, especially during limited-time promotions.

Regularly checking your debit card reward points balance serves as a crucial motivator and goal tracker. This awareness keeps you motivated and focused on your financial goals, ensuring that you make the most of your debit card's cashback program.

Maximizing your cashback rewards requires careful planning and attention to detail. By strategically managing your spending and staying up-to-date on your reward points, you can unlock the full benefits of your debit card purchases with a cashback program and earn from your everyday purchases.

Common Misconceptions About Cashback Rewards

When it comes to cashback rewards, there are a few common misconceptions that people often have. Let's take a closer look at these misconceptions and shed some light on the truth behind them.

Cashback Rewards Equals Free Money

One of the most prevalent misconceptions about cashback rewards is that they are equivalent to free money. While it's true that cashback rewards can be quite lucrative, it's important to understand that they aren't actually free money. Instead, they are a percentage of your spending that is returned to you as a reward for using a particular debit card.

It's crucial to treat cashback rewards as a bonus for your purchases rather than relying on them as a primary source of income. This mindset shift will help you maintain a healthy financial perspective and prevent any unrealistic expectations.

Terms and Conditions

It's worth noting that cashback rewards often come with certain terms and conditions. These may include minimum spending requirements, expiration dates, or limitations on the types of eligible purchases made that qualify for rewards. So, it's essential to read the fine print and understand the specifics of your cashback rewards program to make the most of it.

All Purchases Earn the Same Reward Rate

One common misconception is that all debit card purchases earn the same cashback rate. In reality, debit cards have different reward structures and categories. When choosing a cashback card, align it with your spending patterns. If you dine out frequently, choose a card with higher dining rewards. For substantial grocery spending, opt for a card with a better rate for grocery purchases.

Selecting a card that matches your spending ensures you maximize your cashback rewards. Research and compare options to find the best fit.

Frequently Asked Questions About Cashback Debit Cards

What are cashback rewards?

Cashback rewards are incentives offered by banks and financial institutions when you make purchases using a debit card.

They allow you to earn a percentage of your spending back in cash. For example, if you have a debit card offering 1% cashback and spend $100, you would earn $1 in cashback rewards. These rewards can add up over time and provide extra money in your checking account.

How do cashback rewards work on debit cards?

Cashback rewards on debit card purchases work by returning a portion of your spending as cash. The specific percentage varies depending on the debit card and its terms.

These rewards are typically credited to your checking account periodically, whether monthly, quarterly, or annually. Some debit cards may have minimum thresholds for redemption.

What factors should I consider when choosing a debit card with cashback rewards?

When selecting a debit card with cashback rewards, consider factors such as reward rates and categories that align with your spending habits. Examine annual fees, additional charges, and any associated benefits like purchase protection or travel insurance. Also, assess redemption options and limitations, including minimum withdrawal amounts and expiration dates. Make sure the card fits your long-term financial goals.

Check out our Bold Scholarship Blog to learn more about debit cards. Or check out our Bold Debit Card now to start earning rewards to help you pay for school!

No brands, products, or companies mentioned are affiliated with Bold.org, nor do they endorse or sponsor this article.

Bold.org Visa® Debit Card is a demand deposit account provided by Pathward®, N.A., Member FDIC. Bold.org Visa Debit Card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card can be used everywhere Visa debit cards are accepted. Visa is a registered trademark of Visa U.S.A. Inc. All other trademarks and service marks belong to their respective owners. Register your Card for FDIC insurance eligibility and other protections.

*This product or service is independent of Pathward® and Visa and is neither endorsed nor sponsored by Pathward® or Visa.

**Funds are FDIC insured, subject to applicable limitations and restrictions, once Pathward receives the funds deposited to your account.

†The features associated with the Bold Debit Card discussed in this blog post are provided by Bold.org and are not affiliated with our Bank partners, Pathward®, or Visa.

About Jaeme

Jaeme Velez is an exceptionally dynamic writer, researcher, and avid enthusiast for science and technology. He brings a deep understanding of securing scholarships, obtaining student loans, and navigating the transition from community college to university.

As a first-generation college student, Jaeme began pursuing the dramatic arts and made a significant transition to pursuing academic studies at L.A. Valley College, focusing on Communication and English. He graduated cum laude with a B.A. in Creative Writing at Columbia University in the city of New York. His academic excellence has been recognized through the Casdin Family Scholarship Award and his membership in the Columbia University Honor Society.

Jaeme's academic path is marked by a profound passion for literature and storytelling, particularly in exploring the confluence of diverse cultures and languages while addressing social disparities. Alongside his literary interests, Jaeme maintains a keen curiosity for science and technology, actively engaging in research and projects related to Artificial Intelligence, Design, and human-computer interaction.

Experience

Balancing work and full-time studies as a first-generation college student has endowed Jaeme with a wealth of experience and insights. In his role as a Content Writer at Bold.org, Jaeme shares invaluable wisdom and advice, drawing from his personal journey to provide the guidance he wishes he had received at the start of his academic journey.

His work is fueled by the desire to equip the next generations of students with the knowledge and tools necessary to navigate their unique academic paths. From financial literacy to maintaining a healthy lifestyle, Jaeme strives to contribute to the ongoing discourse on education and support the next generations of scholars, regardless of their age, background, or current stage in life, as they traverse the complexities of higher learning.

Since joining the Bold.org team in 2023, Jaeme has employed his distinctive background as a first-generation student alongside his familiarity with scholarships and student loans to guide students through the intricacies of academic life, emphasizing that every student's journey is distinct and worthy of recognition.

Through his writing and advocacy, Jaeme leverages his personal and professional experiences to provide comprehensive support to students. He is dedicated to empowering students and addressing the challenges they encounter in their pursuit of higher education.

Quote from Jaeme

“Who is the person? What's their problem? Do your research. Offer solutions.”