Are Fundraisers Tax Deductible in 2025?

Understanding the Tax Benefits of Charitable Contributions

Supporting charitable causes through fundraisers is rewarding, but understanding the tax implications ensures you make the most of your contributions.

Fundraisers are a powerful way to support meaningful causes, but not all donations are eligible for tax deductions. To qualify, contributions must be made to a tax-exempt organization, and proper documentation is essential when claiming deductions on your tax return. Personal fundraisers or expenses incurred at events, like buying goods or raffle tickets, are typically not tax-deductible.

In short:

- Contributions must go to qualified tax-exempt organizations.

- Personal fundraiser donations are not tax-deductible.

- Proper documentation is required to claim deductions.

- Fundraisers on platforms like Bold.org are tax-deductible and directly support charitable causes.

Here's a look at what we'll cover:

- What Makes a Fundraiser Tax Deductible?

- The Meaning of a Qualified Charitable Organization

- Criteria for Tax-Deductible Fundraisers

- The IRS and Fundraiser Tax Deductions

- Fundraiser Events and Tax Deductions

- How Bold.org Supports Scholarship Fundraising

- How to Claim Fundraiser Tax Deductions

- Potential Consequences of Incorrectly Claiming Deductions

Keep reading to learn the key factors that make a fundraiser tax-deductible, how to navigate IRS requirements, and how Bold.org simplifies fundraising for scholarship funds.

What Makes a Fundraiser Tax Deductible?

For a fundraiser to be tax-deductible, donations must meet certain requirements. Here’s what you need to know:

1. Who Can Receive Tax-Deductible Donations?

- Donations must go to a qualified nonprofit, such as a:

- 501(c)(3) charity

- Religious organization

- Educational institution

- The fundraiser must serve a charitable, educational, religious, scientific, or public benefit purpose.

- Donations for personal use or private causes aren’t deductible.

2. What Documentation Is Needed?

- Donors need a receipt that shows:

- The donation amount.

- Whether the donor received anything in return. If so, the value of the goods or services must be listed.

- Donations over $250 require formal acknowledgment from the nonprofit.

3. Are There Limits on Deductions?

- Goods or Services: If you receive something in return (e.g., event tickets), you can only deduct the amount exceeding its value.

- Volunteering: You can’t deduct the value of your time, but you may deduct related expenses (e.g., travel or supplies).

4. Special Rules for Auctions & Raffles

- You can deduct only the portion of your payment that exceeds the value of items won or purchased.

- Raffle tickets themselves are not deductible.

Key Takeaway: To make your fundraiser donation tax-deductible, ensure the organization is qualified, the purpose is charitable, and you keep proper documentation. Always check IRS rules or consult a tax professional for specifics.

The Meaning of Qualified Charitable Organization

A qualified charitable organization is a nonprofit recognized by the IRS as meeting specific criteria for tax-exempt status. Donations to these organizations can qualify for tax deductions, allowing individuals to reduce their taxable income. Not all fundraisers meet these requirements. To claim a deduction, the recipient must be a qualified organization.

Key Takeaway: Check the tax-exempt status of the organization before donating to ensure your contribution qualifies for a deduction.

Criteria for Tax-Deductible Fundraisers

Not all fundraisers qualify for tax deductions. Whether a fundraiser is eligible depends on factors like the organization hosting it and the event's purpose. Here are the key considerations:

1. Nonprofit Status of the Organization

- The hosting organization must be a qualified nonprofit with tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

- Eligible organizations typically include educational, religious, scientific, or charitable institutions.

2. Verifying Tax-Exempt Status

- Before donating, verify the organization's tax-exempt status to ensure your contribution qualifies for a deduction.

- The IRS provides a Tax Exempt Organization Search tool to confirm if an organization is tax-exempt. This simple step gives donors confidence that their gift meets the criteria for a tax deduction.

Key Takeaway: Always confirm the nonprofit's eligibility before donating to a fundraiser to ensure your contribution is tax-deductible and supports a qualified cause.

The IRS and Fundraiser Tax Deductions

The IRS establishes the rules for claiming tax deductions on donations. To ensure compliance, donors must meet specific requirements and be aware of certain limitations.

Key IRS Requirements for Tax-Deductible Donations

- Proper Documentation

- Donors must keep records such as receipts or acknowledgment letters from the charitable organization.

- This documentation is essential when filing tax returns to prove the donation was made.

- Deduction Limits

- The IRS limits the amount individuals can deduct based on a percentage of their Adjusted Gross Income (AGI).

- These limits vary depending on the type of donation (e.g., cash, property).

Global Considerations

Tax rules differ across countries. It's important to consult a tax professional or check your country’s tax authority for specific guidelines.

Takeaway: Keep accurate records, understand IRS limits on deductions, and consult professionals to ensure your donations are properly reported.

Fundraiser Events and Tax Deductions

Fundraiser events are a popular way to support charitable causes, but their tax deductibility varies depending on the type of event and how contributions are made. Events like charity auctions, gala dinners, and benefit concerts are often hosted by tax-exempt organizations, making them more likely to qualify for deductions—though not all aspects of participation are deductible.

Understanding What Is (and Isn’t) Deductible

Deductible Contributions

- Direct Donations: Contributions made specifically to the event’s charitable purpose (cash, checks, or non-cash gifts) are typically tax-deductible.

- Excess Contributions: If you pay more than the fair market value of a benefit (e.g., a ticket or auction item), the amount exceeding the value is deductible.

- Example: If you pay $200 for a gala dinner worth $100, the additional $100 may be deductible.

Non-Deductible Expenses

- Raffle Tickets: Payments for raffle or lottery tickets are considered purchases, not donations, and are not deductible.

- Goods Purchased: Items bought at an auction or fundraiser (e.g., art, vacations) are not deductible unless the amount paid exceeds their fair market value.

- Event Costs: Personal expenses like travel or attire for the event are also not deductible.

Examples of Fundraiser Events

- Charity Auctions

- Deduction: Pay more than the market value of an item? The excess is deductible.

- Non-Deductible: The value of the purchased item itself.

- Gala Dinners

- Deduction: If the ticket price exceeds the meal’s value, the difference is deductible.

- Non-Deductible: The cost equivalent to the meal or entertainment provided.

- Benefit Concerts

- Deduction: Donations made without receiving tickets in return are deductible.

- Non-Deductible: The value of the ticket itself.

Takeaway: While fundraiser events can provide a mix of fun and philanthropy, understanding what’s tax-deductible ensures you make the most of your charitable contributions. Always document donations and verify the organization’s tax-exempt status to stay compliant with IRS rules.

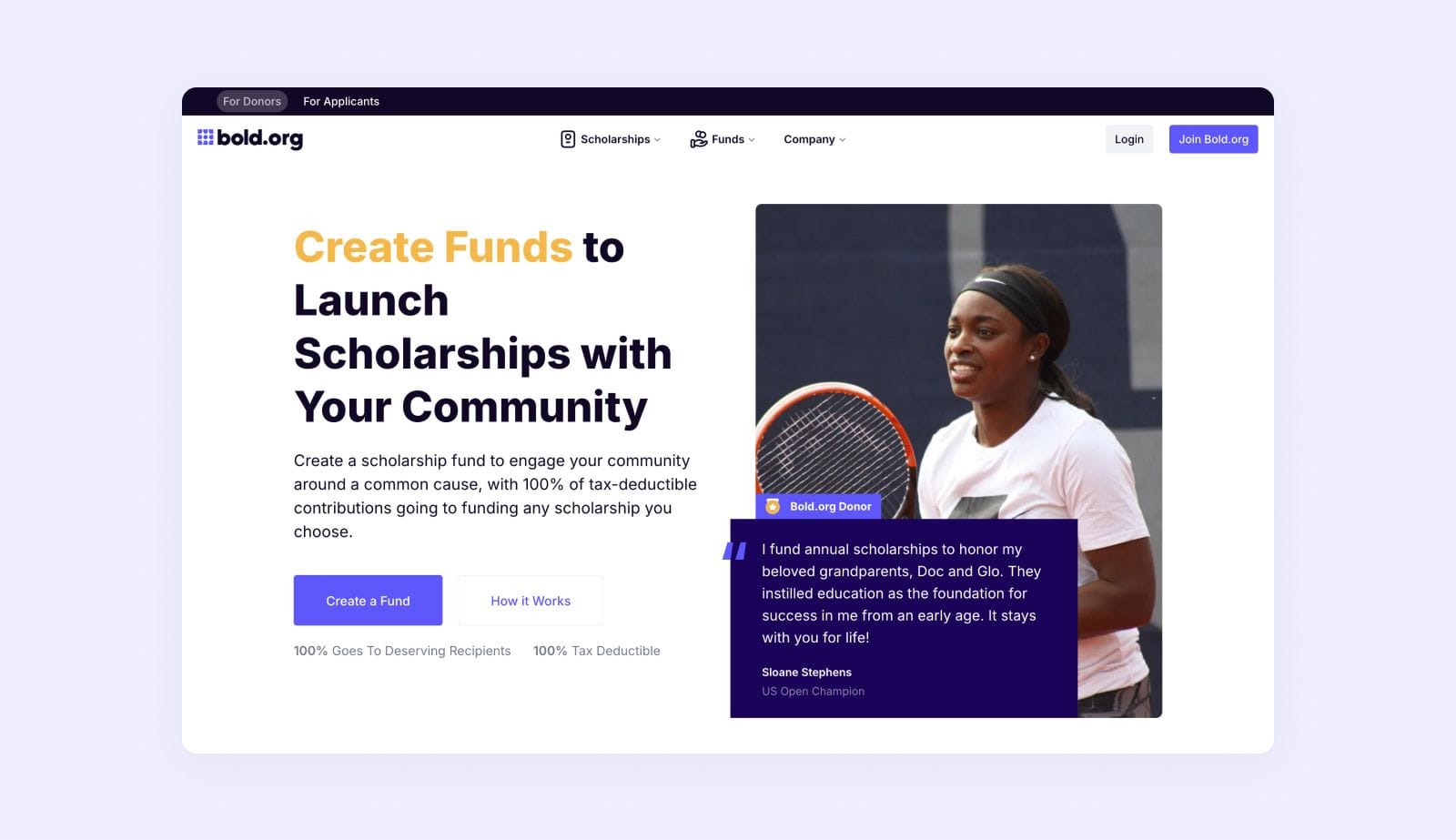

How Bold.org Supports Scholarship Fundraising

Bold.org is a great platform for creating scholarship funds, allowing individuals and organizations to crowdfund in support of students' education. It’s easy to set up, donations are tax-deductible, and you can customize your fund to support the causes you care most about.

Key Benefits of Using Bold.org for Scholarship Fundraising:

- Tax-Deductible Donations: All contributions made through Bold.org are tax-deductible.

- User-Friendly Platform: Setting up a scholarship fund is straightforward, making it accessible to anyone who wants to make an impact.

- Customizable Features: Tailor your scholarship fund as well as your scholarship to align with your mission, whether it's based on a specific field of study, demographics, or other criteria.

- Empowering Education: Every dollar raised goes toward empowering students to achieve their academic and career goals.

By choosing to fundraise with Bold.org, you’re not just fundraising—you’re creating lasting opportunities for students in need.

Takeaway: Bold.org makes it simple to fundraise for scholarships and support education. Start your scholarship fund today and make a lasting difference!

How to Claim Fundraiser Tax Dedcutions

Proper documentation is essential for claiming fundraiser tax deductions. Ensure you keep accurate records, including receipts or written acknowledgments, for contributions exceeding $250.

Key Information for Receipts or Acknowledgments:

- Charity Name: The organization receiving the donation.

- Date and Amount: Clearly stated details of your contribution.

- Exchange of Goods or Services: A statement indicating whether any goods or services were received in return for your donation.

Reporting Fundraiser Tax Deductions on Your Tax Return

To claim fundraiser tax deductions, you’ll need to itemize deductions instead of taking the standard deduction. Here’s how to do it:

- Complete Schedule A: Use this form to report your total itemized deductions, including charitable contributions.

- Calculate Your Donations: Add up all eligible charitable contributions made during the tax year and report the total on Schedule A.

- Retain Supporting Documents: While you don’t need to submit receipts with your tax return, keep records such as receipts or acknowledgments that include the charity’s name, donation date, and amount, as well as a statement about any goods or services received.

- Verify Accuracy: Double-check your total deductions and ensure compliance with IRS requirements to avoid any issues during filing or audits.

For the most accurate and up-to-date- information, consult a tax professional or accountant who can help you through the process of claiming fundraiser tax deductions.

Potential Consequences of Incorrectly Claiming Deductions

Claiming fundraiser tax deductions can reduce your taxable income, but it’s essential to follow IRS guidelines and report contributions accurately. Failing to claim deductions correctly can result in serious financial and legal consequences.

Audits and Fundraiser Tax Deductions

The IRS may audit your tax return if they detect errors or suspect misuse of fundraiser tax deductions. Proper documentation is key to defending your deductions if audited.

What to Expect During an Audit:

- Document Requests: The IRS may require receipts, invoices, or bank statements to verify the legitimacy of your deductions.

- Thorough Examination: Auditors will scrutinize your records for discrepancies or inconsistencies.

- Interviews: The IRS may ask about the nature of your fundraising efforts, the beneficiaries, and the expenses claimed as deductions.

Frequently Asked Questions About Tax Deductible Fundraisers

1. Are political fundraisers tax deductible?

No, political fundraisers are not tax-deductible. While charitable giving to qualified nonprofits may qualify for charitable tax deductions, political contributions fall under separate tax rules and are not eligible.

2. How can charitable donations reduce my tax bill?

Charitable donations may reduce taxable income, which can lower the amount of tax owed. For example, donating to a qualified charity might result in modest tax savings, depending on your tax bracket.

3. Are non-cash donations tax deductible?

Non-cash donations, like clothing or furniture, may be deductible if donated to a qualified charity. Estimating the fair market value of the items and keeping receipts can help when claiming this type of charitable tax deduction.

4. What makes donations on Bold.org qualify as charitable contributions?

Donations on Bold.org qualify as charitable contributions because they are made through the Bold Foundation, a registered 501(c)(3) nonprofit organization. This means your charitable donation meets IRS requirements for tax-deductible donations. Funds donated through Bold.org are directed toward scholarships that benefit students, aligning with the educational and charitable purposes recognized by the IRS.

Make a Difference with a Scholarship Fund on Bold.org

Bold.org offers a simple way to support education and give back to the community through scholarship fundraising. Donations made through the platform are tax-deductible.

Creating a scholarship fund is straightforward and customizable, allowing you to align your efforts with causes you care about. It’s an opportunity to make a meaningful impact on students while donors can also receive tax benefits. Consider starting a scholarship fund today and supporting students in their educational journey.

About Bold.org Donor Team

At Bold.org, our Donor Team is driven by a shared commitment to helping individuals and organizations make a lasting difference through scholarships and charitable giving. We are passionate about supporting donors throughout their philanthropic journey, ensuring that their contributions create lasting, positive change.

Our commitment goes beyond guiding donors through the scholarship process—we also craft educational content that shares our expertise and inspires impactful giving. By creating donor-focused resources, we not only support donors directly but also provide valuable insights to help them navigate their mission of giving with confidence.

With extensive experience in fundraising, scholarship creation, and donor relations, we specialize in bringing your vision to life. Whether it’s crafting a scholarship that reflects your values or ensuring your generosity opens doors for students, our team is here to help you achieve your philanthropic goals.

We believe philanthropy should be accessible, transformative, and deeply rewarding. Every piece of content we write, every scholarship we help build, and every relationship we nurture is driven by our shared goal: to empower donors and change lives through education. Together, we’re shaping a brighter future, one contribution at a time.